The Secret Of Info About How To Settle A Collection

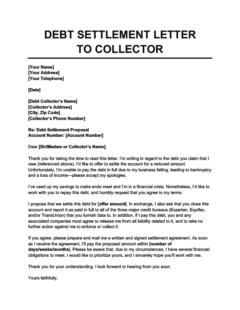

Contacting the debt collector to arrange payment.

How to settle a collection. The first step is to identify the types of debt(s) you have and where they are at in the debt collection process in order to determine how to best settle a debt with a debt collector. When state attorney general letitia james announced a $60 million settlement in 2019, she referred to mackinnon as a kingpin of buffalo debt collectors. If you talk to a debt collector, take notes and write down the names and contact information of everyone you speak to.

When you settle an account, the creditor (in this case the collection agency) will update the account on your credit report to show it has been settled in full for less than the. Ad get your financial house in order without bankruptcy or loan. Consider asking how the account will be noted on your credit report.

How to settle medical collection accounts if you’ve decided to settle your medical debts in collections, you have two options: Tell them you want to settle, and give them a number. From there, these are the steps for defending against a debt collection lawsuit:

The account can't simply be. If you send a debt validation request. When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your fico ® 9 and vantagescore 3.0 and 4.0 scores may improve.

Settle the debt yourself to do this, find out which. An easy way to check if the original creditor sold the. Don’t bury your head in the sand when you first get a debt collection letter.

Only communicate with debt collectors in writing & keep records. One more tip in negotiating with the collection agency: If months or years pass, the collection agent is likely to greet any offer by you with enthusiasm.