Awe-Inspiring Examples Of Tips About How To Choose Term Life Insurance

The premium for a term life policy is usually paid every year or.

How to choose term life insurance. More great reasons why customers choose peopl insurance for their life insurance. Lower the amount of life insurance. But coping with such a devastating loss is hard enough without the added financial worries if that person.

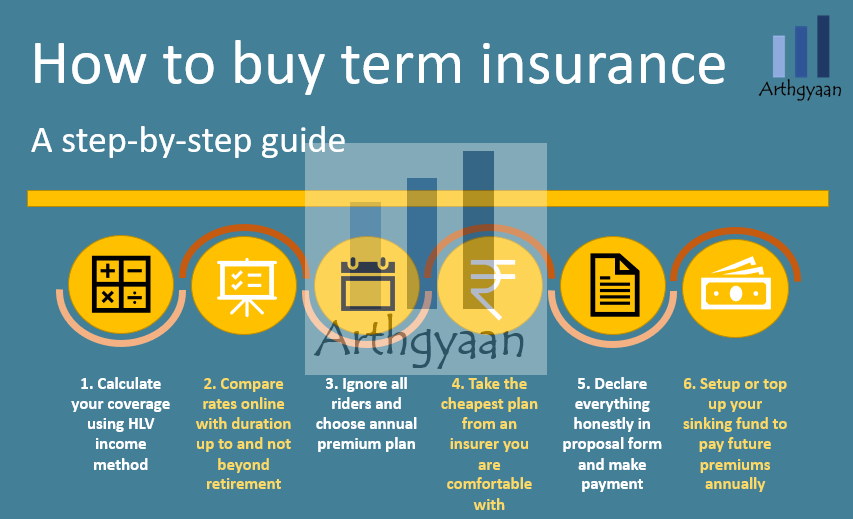

Check for the triple stitching. Term life insurance is the easiest to understand and has the lowest prices. How to choose term life insurance.

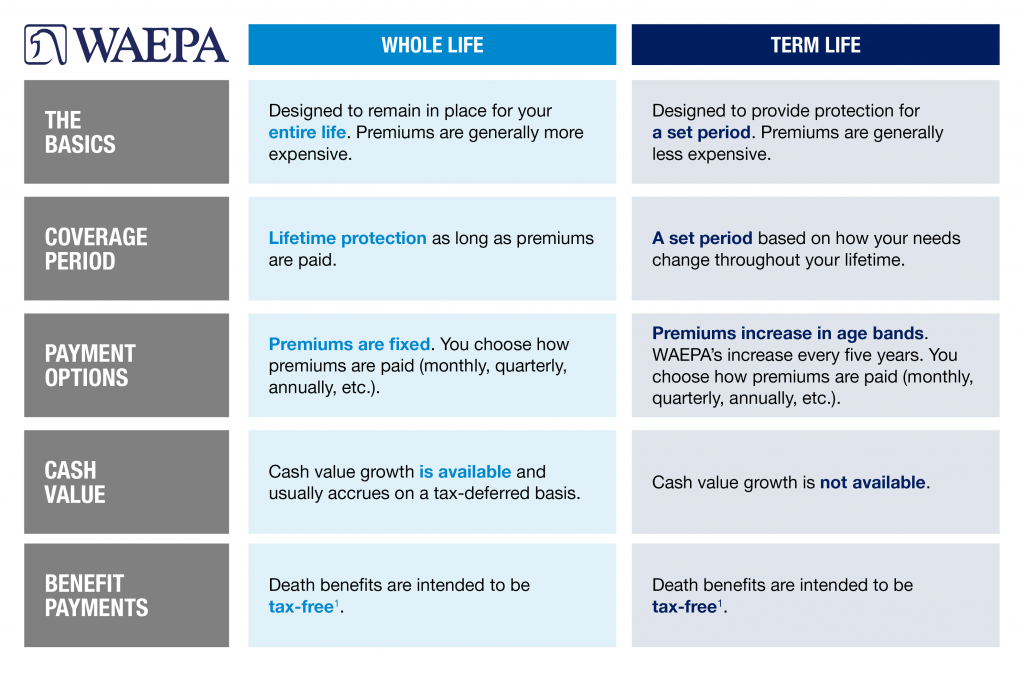

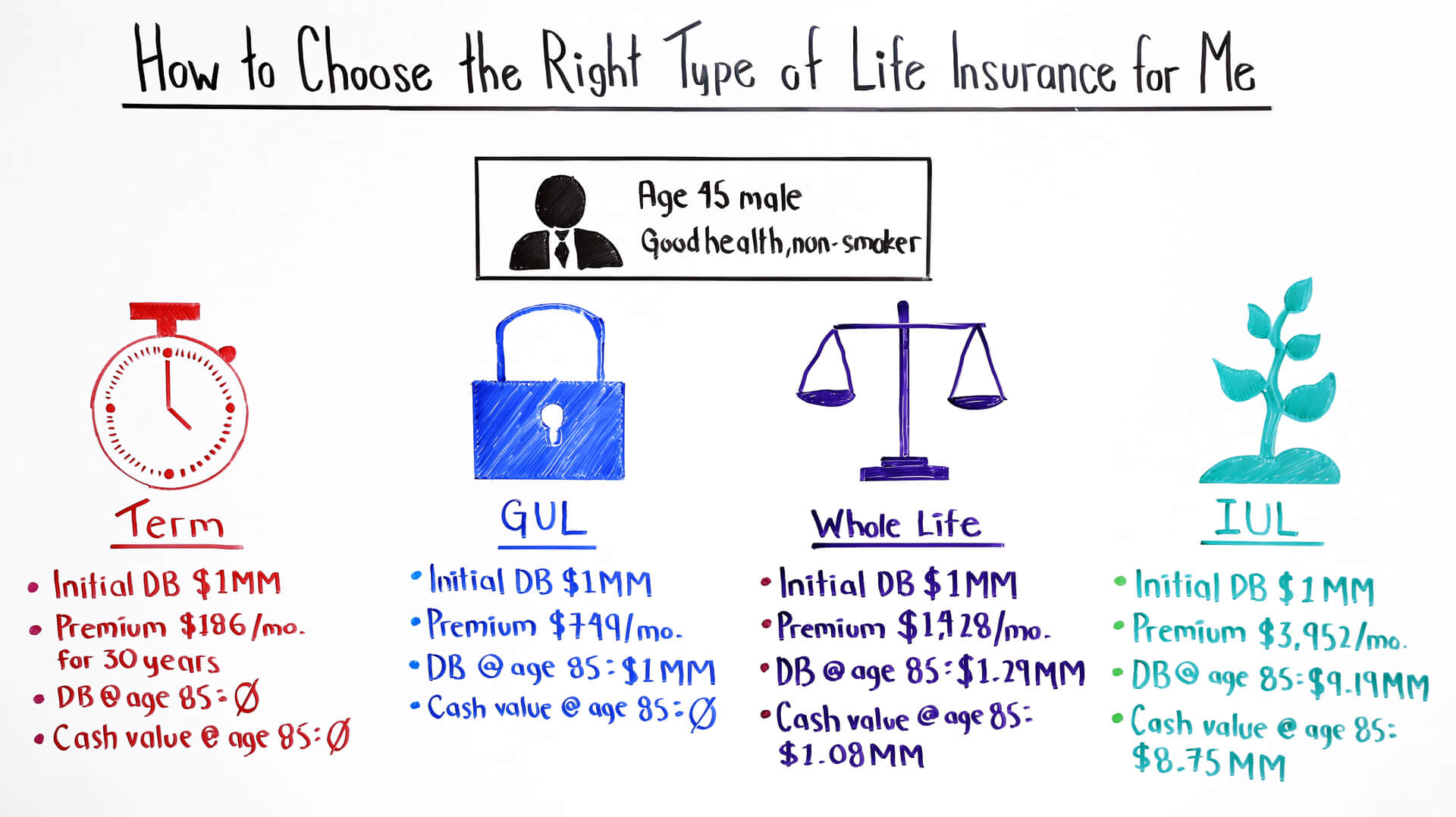

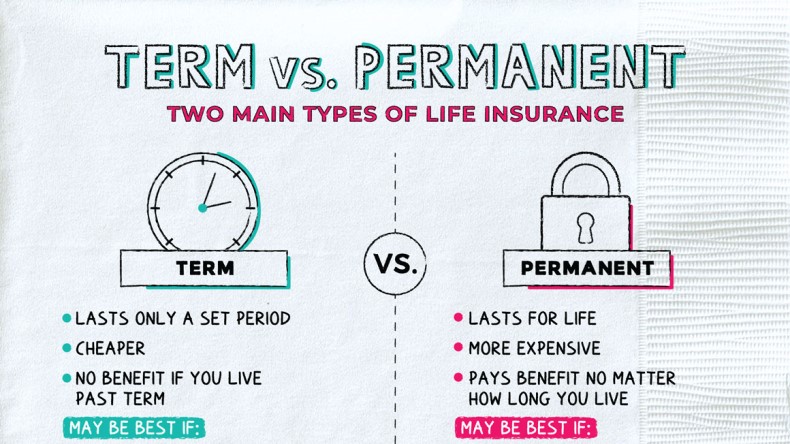

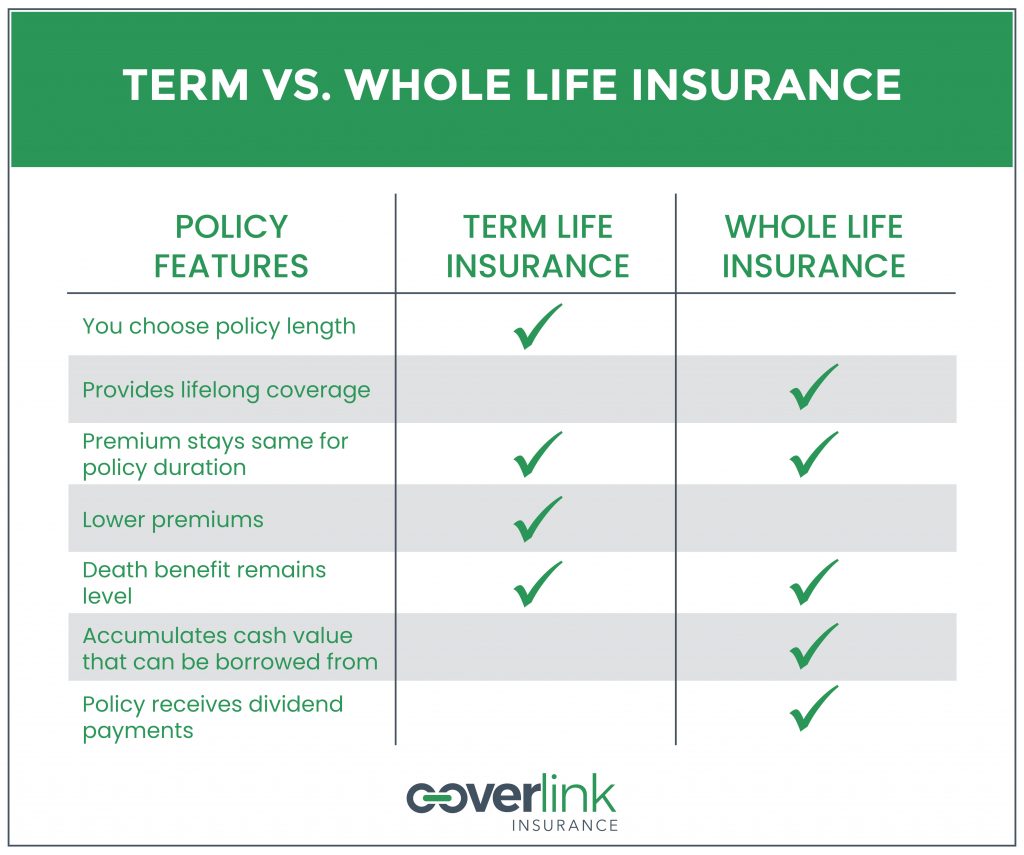

On average, longer term lengths tend to cost more than shorter term lengths. The primary difference between whole life insurance and term life insurance is the duration of the policy. You can make an appointment with an insurer you.

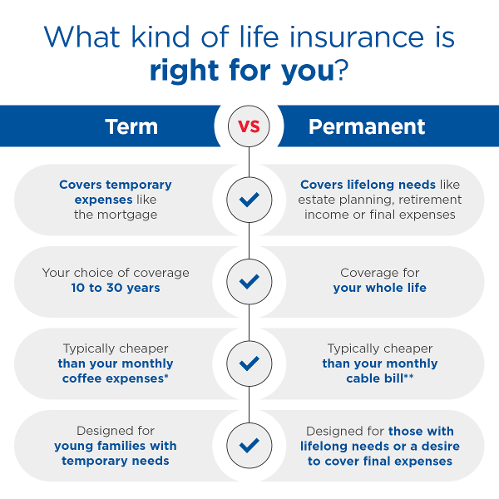

In the span of 20 years, you will likely pay off most of that debt, so the plan acts as a safety net in case you. Financial obligations change over time, so it is important to select a term which is appropriate to your particular circumstances and financial resources. Term life insurance is the simplest and cheapest type of policy, and it’s sufficient for most people.

Choose a shorter term for coverage. Duration is a crucial factor when it comes to selecting the right term insurance plan. Here is a simple checklist which will help you in this process.

How to choose a right term insurance plan make sure your purchase is need based and not peer based!. Ad no exam, just health & other info. Think about how long you need to be insured in order to provide some financial protection to your loved.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)